Income and salary deductions overview in Western Europe

— Press release —

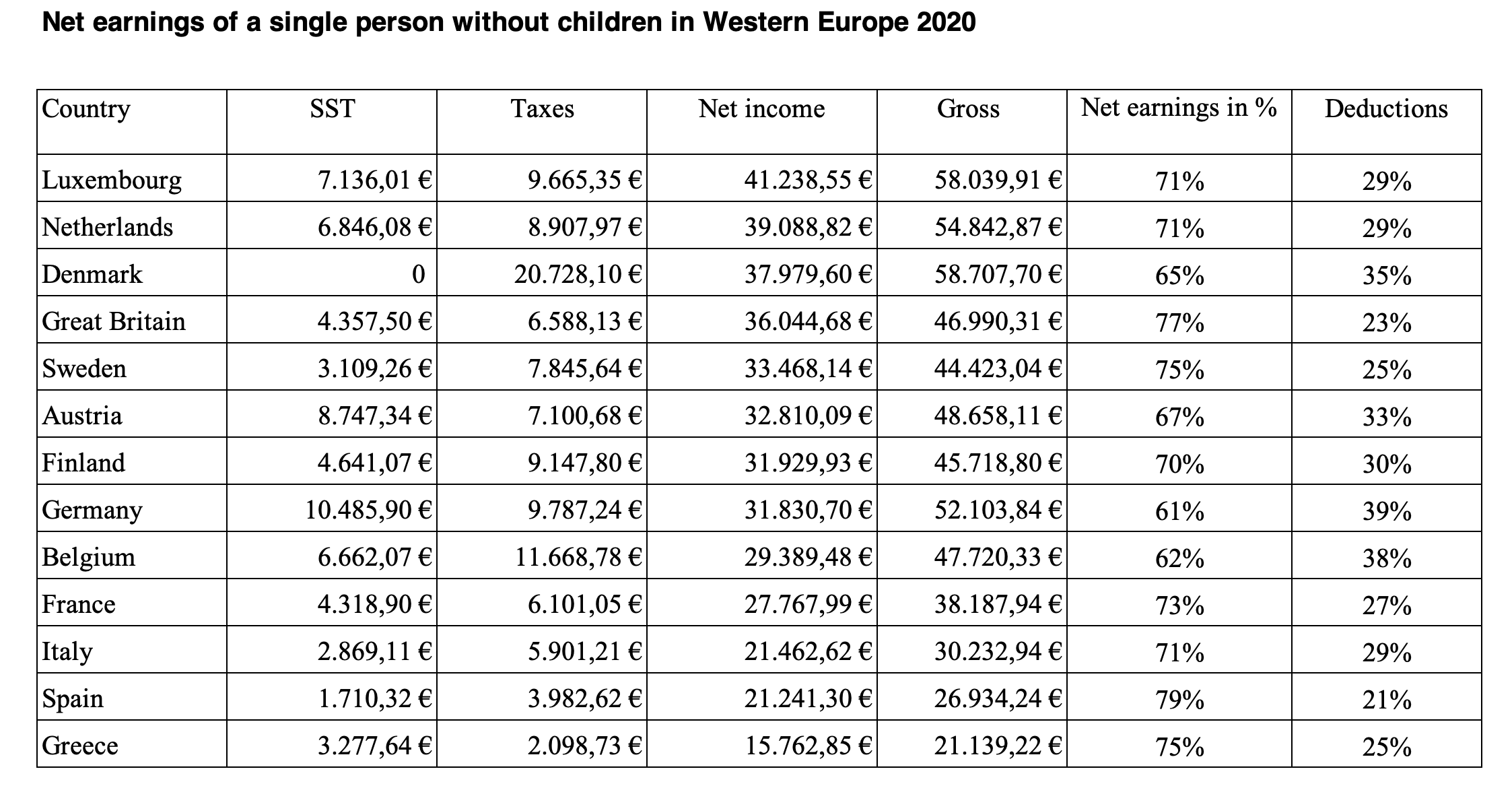

Annual earnings of childless single people in Western European countries differ from those in Eastern Europe. Gross earnings in the European Union in 2020 illustrate this fact. In Denmark, the average gross annual income was the highest in contrast to other countries in Western Europe and amounted to EUR 58,707 annually, followed by Luxembourg with EUR 58,039 and the Netherlands with EUR 54,842. The Southern European countries show however a significantly lower annual gross salary. For example, the earnings in Greece were EUR 21,139, followed by Spain with EUR 26,934 and Italy with EUR 30,232 per year.

As far as deductions are concerned, namely the average social security contributions as well as taxes, they are at the highest level in Germany - 39%, whereas in Spain only 21% must be paid.

If we compare net earnings, Luxembourg is at the top with average income amounting to EUR 41,238 per year. The Netherlands take second place. Here the average salary in 2020 was EUR 39,088. Despite the fact that social security contributions in Denmark shouldn’t be paid at all, the country takes third place. Net salaries are rather high there, although the tax rate is 35%. So, the average annual amount is EUR 37,979.

Here we refer to professional jobs average pay. However, it should be noted that the salaries of highly qualified professionals and managers in Western Europe are by far higher than the average ones in this region.

(Source: www.eurostat.eu)